A Day of Market Volatility: Banking Strength Amidst Widespread Losses

December 25th market saw significant fluctuation, with a clear divergence between large and small-cap stocks. The latter experienced a decline exceeding 3%, while total trading volume reached its lowest point since September 27th. Most sectors saw a surge followed by a drop, leading to a widespread sell-off affecting over 4400 stocks, with more than 60 hitting the daily limit down. However, a few sectors bucked the trend.

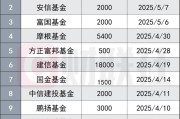

The banking sector showed notable strength, with the four major state-owned banks (ICBC, BOC, CCB, and ABC) hitting record highs. This performance is attributed to improved valuation security and stability due to supportive government policies, bolstering the attractiveness of high-dividend investments in a low-risk-rate environment. Future investment opportunities may lie in high-growth regional banks and the continued stability of large state-owned banks.

Retail stocks witnessed a partial recovery, with several major players experiencing significant gains, fueled by recent government policies aimed at boosting consumer spending and revitalizing the retail sector. These policies encompass initiatives such as promoting consumption, innovating shopping experiences, expanding service consumption, and implementing a trade-in program.

Liquid cooling server concept stocks showed robust activity, driven by strong market growth. This aligns with the broader trend of increased momentum in the AI computing hardware sector, further supported by the successful performance of several related stocks.

The market overall presented a stark contrast between strong performers and the significant losses suffered by most other stocks, indicating a continued risk-off sentiment. The high number of daily limit-down stocks underscores the current market weakness. While some signs of stabilization, such as decreased trading volume and rebound in certain previously popular sectors, indicate a possible turning point, the market is unlikely to recover fully until the widespread losses are mitigated, and investor sentiment improves. Key near-term indicators to watch include the performance of smaller-cap stocks and the number of stocks reaching daily limit-downs. Despite the present volatility, a significant drop is considered unlikely given the previous market corrections. Positive developments from government policies (e.g., encouragement of AI+ applications in manufacturing, reforms to housing sales) are not yet fully reflected in market performance.

相关文章

发表评论